|

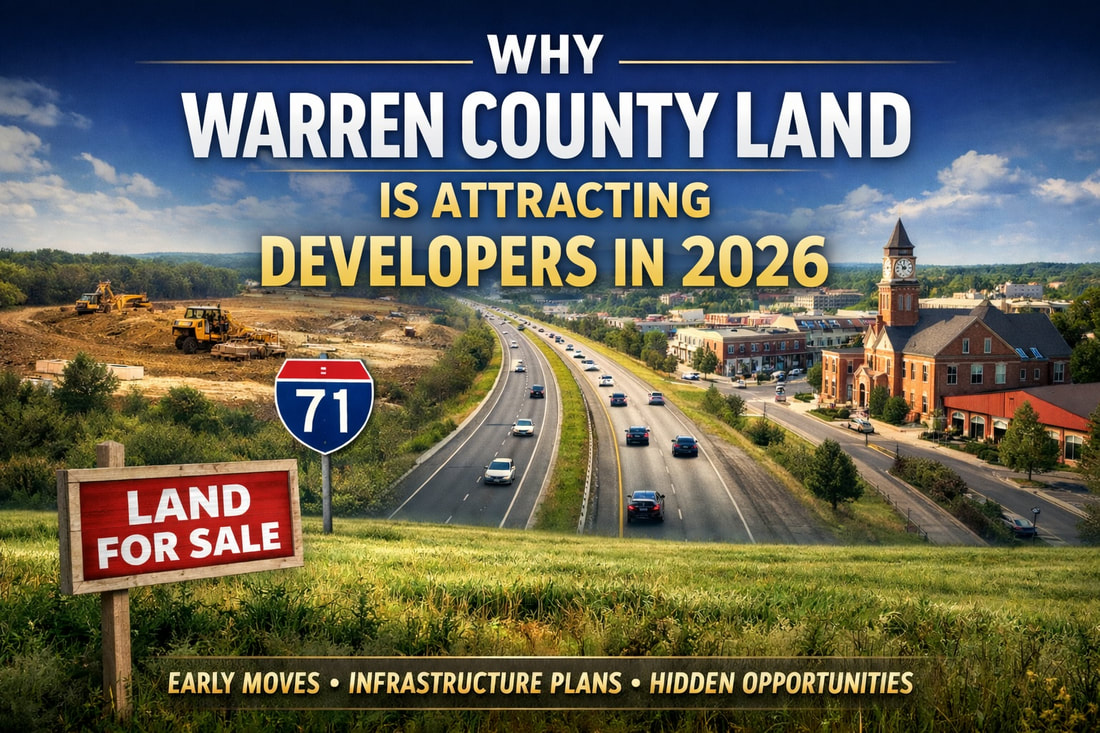

Over the past 12–18 months, I’ve seen a noticeable shift in buyer behavior across Warren County — particularly from developers and well-capitalized land investors. Much of this activity is happening before major announcements, rezonings, or public-facing development plans ever surface.

For landowners, this matters. Timing — not just acreage — is increasingly driving value. Below is what’s actually happening on the ground, and why certain Warren County parcels are drawing quiet but serious interest. Development Pressure Is Expanding Beyond Mason: Mason remains the headline market, but developers are increasingly looking just outside the obvious growth nodes:

Infrastructure Comes Before Headlines: Most land value appreciation tied to development doesn’t occur after infrastructure improvements — it begins during the planning phase. Developers closely track:

Buyer Profiles Have Changed: Today’s active buyers are not casual speculators. They are:

Why Some Landowners Miss the Window: A common mistake I see is landowners waiting for rezoning or public announcements before exploring value. By that point:

What This Means If You Own Land in Warren County: If you own land — especially near growth corridors or expanding municipalities — your property may already be on a developer’s radar, even if no one has contacted you yet. Understanding the following can materially affect both price and terms:

Not all land is meant to be sold — but landowners deserve to understand what their property is worth in today’s market, not based on outdated assumptions or automated estimates. If you’d like a confidential, no-obligation review of your land’s current market position — including buyer demand and development potential — I’m happy to provide one based on real activity in Warren County. Timing matters. Information matters more.

0 Comments

The land market in Southwestern Ohio—including Montgomery, Warren, Clinton, and Greene Counties—remains active but highly segmented. While land does not trade with the same velocity as residential real estate, current absorption trends provide useful insight into demand, pricing power, and timing for sellers and investors.

What Is Land Absorption Rate? Absorption rate measures how quickly available land inventory is being purchased. It is typically expressed as the percentage of active listings that sell within a given period or as months of supply based on current sales activity. Higher absorption indicates stronger demand relative to supply. 📌 Market Snapshot: Southwestern Ohio Land • Absorption Pace: Moderate and stable • Strongest Demand: Development-ready parcels near growth corridors • Slower Segments: Large rural, agricultural, and recreational tracts • Buyer Profile: Builders, developers, and long-term investors • Market Balance: Comparable Ohio counties show low-to-mid-teen absorption rates, generally considered balanced for land markets Current Market Conditions Unlike residential real estate, county-level land absorption rates are not consistently published in public reports or MLS summaries. However, transaction data, days-on-market trends, and development activity across Southwestern Ohio indicate a steady, selective absorption environment.

What This Means for Owners and Buyers

For landowners seeking accurate pricing and strategic positioning, Jared Williams brings specialized expertise in Southwestern Ohio land markets. Buying or selling property in Greene County, Ohio can be complex, whether it’s a rural farm, residential home, or commercial building. Local zoning rules, market trends, and property features require expert knowledge. In this guide, we’ll walk you through every stage—from listing to closing—so you can navigate the Greene County market confidently.

Step 1: Understand the Greene County Real Estate MarketKnowing the market is the foundation of any successful transaction. Greene County offers diverse opportunities:

Step 2: Prepare Your Property or Define Your Search Criteria

Step 3: Partner With a Local Real Estate ExpertAn experienced Greene County agent:

Step 4: Negotiate Offers Effectively

Step 5: Close the Deal with ConfidenceClosing involves inspections, appraisals, and legal documentation. Stay organized and responsive to avoid delays. With careful planning and expert guidance, closing can be a seamless, stress-free experience. Navigating Greene County’s real estate market doesn’t have to be overwhelming. By understanding the market, preparing thoroughly, working with an expert, and staying organized, you can successfully buy or sell property—from farms and historic homes to commercial buildings. Ready to start your Greene County real estate journey? Contact me today at (502) 640-9245 for personalized guidance.  If you buy or sell real estate using an LLC, trust, or other entity, you’ve probably heard more talk lately about FinCEN. While it doesn’t change how property is bought or sold in Ohio day-to-day, it does add new federal reporting requirements that real estate investors need to understand. FinCEN stands for the Financial Crimes Enforcement Network, a bureau of the U.S. Department of the Treasury. Its job is to combat money laundering, fraud, and illegal financial activity by increasing transparency around who actually owns and controls businesses and assets. Historically, all-cash real estate purchases using LLCs or trusts allowed buyers to remain relatively anonymous. FinCEN has identified real estate as a common vehicle for money laundering, especially when properties are purchased through entities rather than individuals. As a result, new federal rules are expanding reporting requirements for certain real estate transactions. Starting December 1, 2025, FinCEN will require reporting for many all-cash residential real estate transactionsinvolving legal entities such as:

Not every transaction triggers FinCEN reporting. The rule primarily targets:

If you plan to buy property through an LLC or trust:

FinCEN rules are about transparency, not restricting real estate investing. For most Ohio buyers, closings will still look the same—but behind the scenes, there is more federal reporting involved when entities and cash purchases are used. If you regularly buy land or residential property through an LLC, it’s smart to talk with your attorney, CPA, or title company now so there are no surprises at closing. Ohio’s land market is off to an active start in 2026, and several regions are standing out as prime opportunities for buyers, investors, and developers. Whether you’re looking for farmland, residential development ground, or long-term investment property, understanding where growth is happening can give you a major advantage.

Here are three Ohio land markets gaining momentum this year. 1. Southwest Ohio: Dayton–Cincinnati Growth Corridor The I-75 corridor between Dayton and Cincinnati continues to attract attention. Expanding logistics hubs, advanced manufacturing, and steady population growth are increasing demand for both industrial and residential land. As housing development pushes outward from city centers, rural and semi-rural tracts in Warren, Butler, and Miami counties are seeing stronger price appreciation and faster sales. 2. Central Ohio: The Columbus Tech and Data Center Boom Central Ohio remains one of the hottest land markets in the Midwest. Ongoing investment in technology, data centers, and infrastructure around Columbus is driving demand for development-ready acreage. Farmland on the outskirts of Franklin, Delaware, and Licking counties is being repositioned for future residential and mixed-use projects, making this area especially attractive for long-term investors. 3. Northwest Ohio: Affordable Land with Rising Demand Northwest Ohio is emerging as a value-driven market. With comparatively lower land prices and improving transportation access, counties around Toledo and Findlay are drawing interest from agricultural operators and developers alike. Industrial expansion tied to manufacturing and energy storage is also boosting demand for large tracts of land. What This Means for Buyers and Sellers For buyers, 2026 presents opportunities to get ahead of future development by securing land in growth corridors before prices climb further. For sellers, well-located properties are commanding strong interest and competitive offers, especially those near major highways and expanding metro areas. Ohio’s land market is becoming more regionally dynamic than ever. Watching these emerging hot spots closely can help you make smarter, more profitable real estate decisions this year and beyond. If you’re considering buying or selling land in one of these areas, local market insight is more important than ever. As investors continue to look for stable, long-term assets, Ohio farmland is standing out as one of the most attractive investment opportunities in 2026. With strong agricultural fundamentals, steady land appreciation, and increasing interest from both local and out-of-state buyers, farmland across the Buckeye State offers a unique mix of income potential and security.

|

AuthorJared M. Williams is a licensed real estate broker who specializes in land and farm sales throughout Ohio. Archives

February 2026

Categories |

RSS Feed

RSS Feed